My analysis Monday morning:

Bernanke is in a sticky situation because he is faced with lower growth expectations as well as elevated inflation. The commentary I am paying attention to is whether he believes these trends are temporary or permanent. If he emphasizes the "transitory" nature of inflation, the FOMC will be more inclined to increase quantitative easing, although I don't think they can say QE outright given the opposition from politicians like Rick Perry. The most likely alternative in my opinion is extending the duration of their portfolio by selling short dated bonds and buying long dated bonds.

Today Bernanke emphasized inflation is below the FOMC's target rate of 2% and will remain at these depressed levels as commodity prices have eased. This commentary is crucial because it opens the door to additional monetary easing, although I doubt it will come in the form of QE3. He also said the FOMC will consider a range of tools which means they are not out of options. He may not have mentioned Operation Twist today, but he definitely laid the groundwork for it when the Fed meets September 20th. Increased expectations for further easing may be the reason gold extended its oversold bounce to close up 3.5%. Also no surprise the Euro is in the early stage of a major break out higher as USD breaks major support levels.

Friday, August 26, 2011

Update

We didn't get much from Bernanke, just a pledge to consider additional measures at the Sept 20 Fed meeting. Maybe that is exactly what this market needs.

Traders reacted skittishly to the lack of details from the speech but what we are seeing now is a significant bounce as Europe rallies into its close (finishing down about 1% across the board but well off the lows). One of my favorite stocks MOS is up 3% and well off lows of 66 as it tests resistance at 69. C rallied back to flat but the financials are relative underperformers this morning (flat while SPX is up 50 bps).

Two bearish indicators post speech:

- Gold is up about 1% to 1785 - usually up on risk aversion but I am not giving it too much weight because it's simply a short term oversold bounce.

- Although off the highs, treasuries are still elevated. I think this has more to do with the GDP miss (1% vs. expectations od 1.1%) than anything Bernanke said.

Why I am still bullish and continue to buy dips:

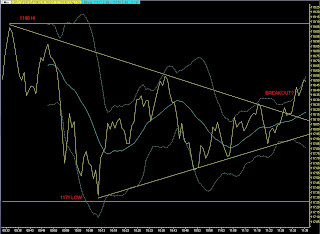

+ The Euro and USD have been a bit bipolar this morning - above the 1.44 level pre mkt, selling off dramatically as Bernanke spoke, bottoming at 1.4330, and now spiking higher above 1.4450. I have been eying this level for weeks now, and I believe we are seeing the first stages of a Euro breakout from the wedge formation I have posted in the past. I'm expecting DXY to break key support and gap down to the 52 wk lows of 73.

Traders reacted skittishly to the lack of details from the speech but what we are seeing now is a significant bounce as Europe rallies into its close (finishing down about 1% across the board but well off the lows). One of my favorite stocks MOS is up 3% and well off lows of 66 as it tests resistance at 69. C rallied back to flat but the financials are relative underperformers this morning (flat while SPX is up 50 bps).

Two bearish indicators post speech:

- Gold is up about 1% to 1785 - usually up on risk aversion but I am not giving it too much weight because it's simply a short term oversold bounce.

- Although off the highs, treasuries are still elevated. I think this has more to do with the GDP miss (1% vs. expectations od 1.1%) than anything Bernanke said.

Why I am still bullish and continue to buy dips:

+ The Euro and USD have been a bit bipolar this morning - above the 1.44 level pre mkt, selling off dramatically as Bernanke spoke, bottoming at 1.4330, and now spiking higher above 1.4450. I have been eying this level for weeks now, and I believe we are seeing the first stages of a Euro breakout from the wedge formation I have posted in the past. I'm expecting DXY to break key support and gap down to the 52 wk lows of 73.

Wednesday, August 24, 2011

Update

Friday is going to be a very important day: Q2 GDP estimates at 8:30am, and the Bernank speaking from Jackson Hole at 10am.

Gold off $100 to 1760. If yesterday's move was in fact the market betting on a "Fed Miracle" ie QE,3 why would gold have such a dramatic sell off these past two days? A third round of quantitative easing is about the only catalyst for gold to sustain its parabolic move to 1900. Also, the dollar index (DXY) is slightly positive today and the Euro continues to fail @ 1.4450. If the market truly expects QE3, the dollar should be getting crushed.

Despite lower growth expectations and continued weakness in employment and housing, the Fed cannot pull out the bazooka - not yet at least - because of rising inflationary pressures. The money supply, a leading indicator, continues to grow - M1 increased 5.5% m/m and 20.8% YoY, and the YoY increase in the last two weeks is the highest in history (The Bonddad Blog). So what options does the Bernank have? The most likely scenario is not additional printing but a shift in the Fed's balance sheet from short term bonds to longer term maturities - Operation Twist Redux I mentioned a few days ago. This will have the intended effect of lowering long term interest rates which will support the housing market.

But will implementing OT Redux have this effect? It is important to remember what happened when the Fed initially committed to quantitative easing - rates actually shot up! Investors sold treasuries and reallocated into risker assets (stocks), a counterintuitive move but one that makes sense given the inflationary pressure of QE. So if the Fed commits to buying longer dates maturities (30 yr), I'm expecting the same effects - the yield curve will steepen, and money will flow from bonds into equities. This may be why we have seen yields rise in the past couple days as the 30 yr has fallen off 4% and the oversold financial sector has bounced 5% (financials will ultimately benefit from a steepening yield curve). A caveat: this analysis is dependent on a GDP number which is inline with estimates. We are expecting 1.1% real annualized growth, and a miss coming in just about flat (or even negative!) would certainly send treasuries higher and spur more talk of a double dip recession.

My game plan on a inline GDP number: TBT and C

Gold off $100 to 1760. If yesterday's move was in fact the market betting on a "Fed Miracle" ie QE,3 why would gold have such a dramatic sell off these past two days? A third round of quantitative easing is about the only catalyst for gold to sustain its parabolic move to 1900. Also, the dollar index (DXY) is slightly positive today and the Euro continues to fail @ 1.4450. If the market truly expects QE3, the dollar should be getting crushed.

Despite lower growth expectations and continued weakness in employment and housing, the Fed cannot pull out the bazooka - not yet at least - because of rising inflationary pressures. The money supply, a leading indicator, continues to grow - M1 increased 5.5% m/m and 20.8% YoY, and the YoY increase in the last two weeks is the highest in history (The Bonddad Blog). So what options does the Bernank have? The most likely scenario is not additional printing but a shift in the Fed's balance sheet from short term bonds to longer term maturities - Operation Twist Redux I mentioned a few days ago. This will have the intended effect of lowering long term interest rates which will support the housing market.

But will implementing OT Redux have this effect? It is important to remember what happened when the Fed initially committed to quantitative easing - rates actually shot up! Investors sold treasuries and reallocated into risker assets (stocks), a counterintuitive move but one that makes sense given the inflationary pressure of QE. So if the Fed commits to buying longer dates maturities (30 yr), I'm expecting the same effects - the yield curve will steepen, and money will flow from bonds into equities. This may be why we have seen yields rise in the past couple days as the 30 yr has fallen off 4% and the oversold financial sector has bounced 5% (financials will ultimately benefit from a steepening yield curve). A caveat: this analysis is dependent on a GDP number which is inline with estimates. We are expecting 1.1% real annualized growth, and a miss coming in just about flat (or even negative!) would certainly send treasuries higher and spur more talk of a double dip recession.

My game plan on a inline GDP number: TBT and C

Monday, August 22, 2011

Update

Sometimes doing nothing is the best decision. Obviously shorting the open would have been most lucrative but at least I didn't chase the market as it quickly erased 2% gains. I watched the Euro reverse and go negative on the day - hovering around the 1.437 level and continue to watch 1.4450 as a bullish indicator. Gold continued higher finished up 2.5%.

The worrisome part of today's action is the fact we couldn't sustain any sort of a rally after Europe closed up 2%. Also interesting to note financials continued to underperform as the weakest sector today - down 1.25%. I still think we are in a bottoming process and testing and holding 1100 would be an important support level and a great buying opportunity.

The worrisome part of today's action is the fact we couldn't sustain any sort of a rally after Europe closed up 2%. Also interesting to note financials continued to underperform as the weakest sector today - down 1.25%. I still think we are in a bottoming process and testing and holding 1100 would be an important support level and a great buying opportunity.

Monday morning

+ Europe higher across the board: CAC and FTSE up about 2.5%, DAX up 1%. Euro is up slightly to 1.4425. I will keep a close eye on the 1.4450 level.

+ Chicago Fed a little better than expected. -0.06 vs -0.48 expected

+ Treasuries slightly lower

- Gold reached 1890 overnight extending the parabolic move higher. It's off the highs but still up about 1% to 1866. SPX futures up 1.65% pre mkt. Less inclined to buy the open (still bullish but less so than pre mkt Friday). If we continue to rally today, I want to see a Euro break out above 1.4450 and lower gold as bullish confirmations before I chase.

Big story this week is the Jackson Hole conference on Friday. Bernanke is in a sticky situation because he is faced with lower growth expectations as well as elevated inflation. The commentary I am paying attention to is whether he believes these trends are temporary or permanent. If he emphasizes the "transitory" nature of inflation, the FOMC will be more inclined to increase quantitative easing, although I don't think they can say QE outright given the opposition from politicians like Rick Perry. The most likely alternative in my opinion is extending the duration of their portfolio by selling short dated bonds and buying long dated bonds. This will not increase their balance sheet and will attempt to lower longer dated interest rates which will help the real estate market. The Fed did this in the early 60s and the program was coined "Operation Twist," so I'm calling for a OT Redux. Many analysts, however, doubt the effectiveness of this plan because it only managed to lower long term rates by about 15 bps.

+ Chicago Fed a little better than expected. -0.06 vs -0.48 expected

+ Treasuries slightly lower

- Gold reached 1890 overnight extending the parabolic move higher. It's off the highs but still up about 1% to 1866. SPX futures up 1.65% pre mkt. Less inclined to buy the open (still bullish but less so than pre mkt Friday). If we continue to rally today, I want to see a Euro break out above 1.4450 and lower gold as bullish confirmations before I chase.

Big story this week is the Jackson Hole conference on Friday. Bernanke is in a sticky situation because he is faced with lower growth expectations as well as elevated inflation. The commentary I am paying attention to is whether he believes these trends are temporary or permanent. If he emphasizes the "transitory" nature of inflation, the FOMC will be more inclined to increase quantitative easing, although I don't think they can say QE outright given the opposition from politicians like Rick Perry. The most likely alternative in my opinion is extending the duration of their portfolio by selling short dated bonds and buying long dated bonds. This will not increase their balance sheet and will attempt to lower longer dated interest rates which will help the real estate market. The Fed did this in the early 60s and the program was coined "Operation Twist," so I'm calling for a OT Redux. Many analysts, however, doubt the effectiveness of this plan because it only managed to lower long term rates by about 15 bps.

Friday, August 19, 2011

Update

Had about an hour of fun today. Here's a home run trade gone wrong (keep in mind this is 100% of my book):

What I should have been watching - Euro:

Notice how the Euro peaked at 10:15 but the market peaked at 10:30. I had 15 minutes to get out of my long position. Also notice the Euro broke its uptrend line at 10:30, exactly the moment the market topped. This was an easy exit point, especially given such quick gains, and in retrospect, the most lucrative one.

What I should have been watching - Euro:

Notice how the Euro peaked at 10:15 but the market peaked at 10:30. I had 15 minutes to get out of my long position. Also notice the Euro broke its uptrend line at 10:30, exactly the moment the market topped. This was an easy exit point, especially given such quick gains, and in retrospect, the most lucrative one.

Update

Went aggressively long at the open. 100% of book in SSO (2x S&P ETF) @ 38.14

The only chart you need to look at this morning:

The break out is looming. As Joshua Brown says, get read for a "rip your face off" rally.

The only chart you need to look at this morning:

The break out is looming. As Joshua Brown says, get read for a "rip your face off" rally.

Friday morning

Futures down about 1% on European weakness. We're bumping up against some major support - I'm looking at 1120 and then the all important last line of defense 1100. I'm not going to wait for these numbers this morning as I am buying aggressively.

Why am I buying?

- USD is actually slightly weaker this morning. Euro up slightly @ 1.44 on Eurobond rumors

- Despite the 4% sell off yesterday, the close was pretty impressive as we rallied about 12 handles in SPX in the last 15 min.

- Treasuries have been flat to slightly lower this morning. May indicate less risk aversion as investors shift from bonds to risk assets

Why am I buying?

- USD is actually slightly weaker this morning. Euro up slightly @ 1.44 on Eurobond rumors

- Despite the 4% sell off yesterday, the close was pretty impressive as we rallied about 12 handles in SPX in the last 15 min.

- Treasuries have been flat to slightly lower this morning. May indicate less risk aversion as investors shift from bonds to risk assets

Thursday, August 18, 2011

Update

If you haven't realized yet, I pretty much spend all day watching FX. What I'm realizing today is the relative outperformance of the Euro. It's down 75 bps but considering the DAX was down 7% at one point, this move is relatively small. In fact, the Euro has simply retraced its move from Monday. Compare the 5-day charts of the Euro, DXY index (USD), DAX index, and SPY.

Euro:

DXY index:

DAX index:

SPY:

So what does this relative outperformance indicate? First, USD is considered less of a safe haven. Second, the Euro breaking out of its range is just around the corner. And third, this sell off in SPX is consolidation and we're in the early stages of forming a sustainable bottom.

Euro:

DXY index:

DAX index:

SPY:

So what does this relative outperformance indicate? First, USD is considered less of a safe haven. Second, the Euro breaking out of its range is just around the corner. And third, this sell off in SPX is consolidation and we're in the early stages of forming a sustainable bottom.

Update

If you are not in cash, you should try it sometime. Feels good. Lot of opportunities out there.

Banks are getting absolutely crushed. C and BAC down 10%? Barclays off 11%? Yikes. 10 yr broke 2%! SPX stalled at 1152 then got absolutely hammered on the biggest Philly Fed miss since 1998.

Here's the Euro chart which I've been studying this past week and why I've been cautious the past four days. Despite the DAX being down 7%, the Euro is only off 1%, which support my thesis that it will be stuck in this range before breaking out higher on a weakening dollar.

My hands are tied until FXE reaches the 141.70 level. At that point, I expect Euro support (USD weakness) and I will be comfortable playing commodities on the long side.

Banks are getting absolutely crushed. C and BAC down 10%? Barclays off 11%? Yikes. 10 yr broke 2%! SPX stalled at 1152 then got absolutely hammered on the biggest Philly Fed miss since 1998.

Here's the Euro chart which I've been studying this past week and why I've been cautious the past four days. Despite the DAX being down 7%, the Euro is only off 1%, which support my thesis that it will be stuck in this range before breaking out higher on a weakening dollar.

My hands are tied until FXE reaches the 141.70 level. At that point, I expect Euro support (USD weakness) and I will be comfortable playing commodities on the long side.

Thursday morning

Ugly morning in Europe. CDS blowing up, banks down huge and some are halted, DAX down 4%, CAC and FTSE down about 3%. SPX futures down 2%, finding support around the 1172 area which I've been eying as a possible entry point on weakness. Next level is 1152. As I've been saying for the past 3 or 4 days, it's important to differentiate between an oversold bounce and a sustainable rally. The 7% bounce from 1100 lows was simply an oversold bounce and it will be important to see consolidation and retest levels of support before we can have a healthy rally above 1200. Also important to realize that other than a short selling ban and an uneventful meeting between France and Germany, nothing in Europe has changed.

I remain cautious and will look for any bounce in European indices to lead a SPX relief rally. Also I want to see the Euro come in to the 141.50-142 level in FXE before I become bullish on commodities. I'm surprised the Euro is not weaker this morning, down marginally to 1.437.

8:30 data: Initial jobless claims missed expectations by 8k to 408k. July CPI +0.5% vs exp +0.2% prev -0.2%. Annual Core CPI 1.8% from 1.6% vs exp 1.7%. Depressed growth expectations coupled with higher than expected PPI and CPI point to stagflation - not good for the bull case.

10:00 data: Philly Fed, Existing Home Sales, and Leading Indicators

I remain cautious and will look for any bounce in European indices to lead a SPX relief rally. Also I want to see the Euro come in to the 141.50-142 level in FXE before I become bullish on commodities. I'm surprised the Euro is not weaker this morning, down marginally to 1.437.

8:30 data: Initial jobless claims missed expectations by 8k to 408k. July CPI +0.5% vs exp +0.2% prev -0.2%. Annual Core CPI 1.8% from 1.6% vs exp 1.7%. Depressed growth expectations coupled with higher than expected PPI and CPI point to stagflation - not good for the bull case.

10:00 data: Philly Fed, Existing Home Sales, and Leading Indicators

Wednesday, August 17, 2011

Too funny not to post

At 11:05 I tweeted:

This was when SPX was sitting up about 80 bps before the sell off (we are now down 50 bps). Anyways, at 1pm Pisani comes on air and says, "We may be seeing the beginning of buyer exhaustion." He reversed his original statement exactly 2 hrs after my tweet!

This was when SPX was sitting up about 80 bps before the sell off (we are now down 50 bps). Anyways, at 1pm Pisani comes on air and says, "We may be seeing the beginning of buyer exhaustion." He reversed his original statement exactly 2 hrs after my tweet!

Noon

Once again the Euro tells the tale of the tape, and my caution has paid off. Euro continued its slide, and (surprise, surprise) SPX erased its 1% gain. For the moment we have found support at 1190.

10:41

Euro intra day:

SPY intra day:

11:05 - just to call out my least favorite reporter (note this was before the majority of the sell off):

10:41

Euro intra day:

11:05 - just to call out my least favorite reporter (note this was before the majority of the sell off):

Update

Missed some upside this morning (two favorite stocks FCX and MOS up 2-3%) but did not chase and still cautious as it looks like the Euro is failing to break out and drifting lower. Weak action considering it's at what I consider a pivot point. The reversal may be aggressive and I expect the market to follow. Also SPX up 1% but treasuries flat? Not a bullish sign.

Reasons for a possible Euro reversal:

- tepid growth in the GDP out of Europe yesterday decreases probability of further rate hikes

- PPI higher than expected could lend support to the dollar

Reasons for a possible Euro reversal:

- tepid growth in the GDP out of Europe yesterday decreases probability of further rate hikes

- PPI higher than expected could lend support to the dollar

Wednesday morning

With the Euro trying to break above 1.4450, lets take a look at the vulnerability of the dollar.

DXY index:

You would have to have some serious conviction to step in front of this chart on the long side. Certain technical cliches come to mind, such as "there is no such thing as a triple bottom." Take a look at a longer term chart below. I can see the index easily gaping down to 72.70 lows (red line) we saw in May before it finds support. The only mitigating factor is PPI this morning coming in higher than expected, an inflationary indicator which will provide support for the dollar here. I am still sitting tight on playing commodities until I see a full fledged break out of the Euro - may be just around the corner.

DXY index:

You would have to have some serious conviction to step in front of this chart on the long side. Certain technical cliches come to mind, such as "there is no such thing as a triple bottom." Take a look at a longer term chart below. I can see the index easily gaping down to 72.70 lows (red line) we saw in May before it finds support. The only mitigating factor is PPI this morning coming in higher than expected, an inflationary indicator which will provide support for the dollar here. I am still sitting tight on playing commodities until I see a full fledged break out of the Euro - may be just around the corner.

Tuesday, August 16, 2011

A recap

Why I am cautious on commodities in the short term:

The main catalyst driving the Euro higher is not Euro strength but dollar weakness. We know Bernanke is keeping rates low for 2 years, making the Euro much more attractive even with its issues. Yesterdays gap up in the Euro was most likely buying/covering in front of GDP numbers and the press conference today and investors positioning for a break out of this wedge. A positive for the Euro out of the press conference is the reluctance to expand EFSF - even though many feel like EFSF is currently too small to work, expanding the facility would further monetize and weaken the currency.

So why has the Euro failed to break the wedge? Weakness today can be blamed on the less than expected GDP out of Europe. Tepid growth will continue to weigh on the Euro in the short term because the ECB's focus will shift from rising inflation to a slowing economy and will now not only keep rates steady but may actually lower rates. I'm expecting the Euro to remain bound to the range depicted above and I will stay cautious on commodities until it eventually breaks out to the upside on dollar weakness. When it does - it could be tomorrow or in a month - I will buy risk assets with conviction.

Another factor contributing to dollar strength/Euro weakness in the short term is a possible retest of support levels in SPX (1172 and 1150) which I think is an important consolidation move before starting a sustainable rally. Today is a good start with energy and financials down 2%. As I mentioned yesterday, what we saw on Thurs-Mon was nothing more than oversold bounce. Worst thing you can do is chase it.

The main catalyst driving the Euro higher is not Euro strength but dollar weakness. We know Bernanke is keeping rates low for 2 years, making the Euro much more attractive even with its issues. Yesterdays gap up in the Euro was most likely buying/covering in front of GDP numbers and the press conference today and investors positioning for a break out of this wedge. A positive for the Euro out of the press conference is the reluctance to expand EFSF - even though many feel like EFSF is currently too small to work, expanding the facility would further monetize and weaken the currency.

So why has the Euro failed to break the wedge? Weakness today can be blamed on the less than expected GDP out of Europe. Tepid growth will continue to weigh on the Euro in the short term because the ECB's focus will shift from rising inflation to a slowing economy and will now not only keep rates steady but may actually lower rates. I'm expecting the Euro to remain bound to the range depicted above and I will stay cautious on commodities until it eventually breaks out to the upside on dollar weakness. When it does - it could be tomorrow or in a month - I will buy risk assets with conviction.

Another factor contributing to dollar strength/Euro weakness in the short term is a possible retest of support levels in SPX (1172 and 1150) which I think is an important consolidation move before starting a sustainable rally. Today is a good start with energy and financials down 2%. As I mentioned yesterday, what we saw on Thurs-Mon was nothing more than oversold bounce. Worst thing you can do is chase it.

S/M press conference

Initial reaction: Euro spiked testing yesterday's highs.

Proposal for a new Euro Zone Economic Counsel and a Euro Zone President to increase economic coordination. Also proposed a new tax on all financial transactions starting in Sept. Not surprisingly, Eurobond solution absent from talks.

After spiking Euro is now settling down in the 1.44-1.4450 range:

I'll become much more bullish if we break resistance of 1.4450. Until then I remain cautious and sit tight. An impressive rally though, especially after weak GDP numbers, so I'm expecting a break out sooner rather than later.

Noon

Euro rallying ahead of Sarkozy/Merkel press conference:

Down just marginally on the day. SPX also rallying from 1188 lows. Tested 1200 and sitting at 1198 down just 40 bps.

Down just marginally on the day. SPX also rallying from 1188 lows. Tested 1200 and sitting at 1198 down just 40 bps.

Morning update

Another 1188-1200 bound market today?

Not sure why there's so much Eurobond speculation today when everyone knows that option is off the table and prohibited from the Sarkozy/Markel talks. If traders are expecting some sort of Eurobond solution, I would sell the news as missed expectations would mean weakness for both the Euro and the market. CHF continues to fall ahead of Swiss National Bank meeting tomorrow, which may peg it to the Euro.

Not sure why there's so much Eurobond speculation today when everyone knows that option is off the table and prohibited from the Sarkozy/Markel talks. If traders are expecting some sort of Eurobond solution, I would sell the news as missed expectations would mean weakness for both the Euro and the market. CHF continues to fall ahead of Swiss National Bank meeting tomorrow, which may peg it to the Euro.

Tuesday morning

A moderate Euro reversal given how bad the Euro GDP numbers were: Q2 at 0.2% (0.8% annualized) vs expectations of 0.3%, and Germany at 0.1% vs. expectations of 0.5%.

SPX futures down 1.5% on weakness in Europe: DAX down 2.6%, CAC down 2%, and FTSE down 1%. I expected the Euro to fully reverse its move yesterday to the 1.43 level, although Sarkozy and Merkel have yet to meet which may lead to further Euro weakness. Also, Euro sovereign CDS are wider across the board, another leading indicator.

Today I am watching the Euro closely and any signs of a relief rally in Euro markets into their close.

Interesting to note Euro is trying to hold 1.4370 level where it bottomed during market hours yesterday. Just a coincidence SPX is also trying to hold the lows? This is significant because if it does hold the lows, it won't take much for it to rally and retest 1.4450 resistance. This will mean the "short USD, long risk assets" trade is still intact and will accelerate with a breakout in the Euro. The fact that the Euro is not getting crushed here speaks to the fundamental weakness of USD. This relationship could change if the ECB becomes more dovish and loosens monetary policy by lowering rates (thus making the Euro less attractive relative to USD), maybe not so unreasonable given the tepid GDP numbers this morning. But this only becomes relevant when the ECB meets next on September 8.

SPX futures down 1.5% on weakness in Europe: DAX down 2.6%, CAC down 2%, and FTSE down 1%. I expected the Euro to fully reverse its move yesterday to the 1.43 level, although Sarkozy and Merkel have yet to meet which may lead to further Euro weakness. Also, Euro sovereign CDS are wider across the board, another leading indicator.

Today I am watching the Euro closely and any signs of a relief rally in Euro markets into their close.

Interesting to note Euro is trying to hold 1.4370 level where it bottomed during market hours yesterday. Just a coincidence SPX is also trying to hold the lows? This is significant because if it does hold the lows, it won't take much for it to rally and retest 1.4450 resistance. This will mean the "short USD, long risk assets" trade is still intact and will accelerate with a breakout in the Euro. The fact that the Euro is not getting crushed here speaks to the fundamental weakness of USD. This relationship could change if the ECB becomes more dovish and loosens monetary policy by lowering rates (thus making the Euro less attractive relative to USD), maybe not so unreasonable given the tepid GDP numbers this morning. But this only becomes relevant when the ECB meets next on September 8.

Monday, August 15, 2011

Afternoon update

This morning SPX opened at the highs we saw Friday (1188) and rallied up to 1200 but did not break it. We then tested 1188 again and it proved to be a new support level. We saw this pattern last week - previous resistance levels becoming new support levels as the market trends higher.

Market remains range bound, but I now think there is short term risk to the downside because of recent Euro strength, which I'm expecting to reverse tomorrow. Euro hit my target of 1.4550 and has been stuck there pretty much all day. I'm expecting Euro weakness tomorrow on the Sarkozy/Merkel meeting, and Euro debt issues will return to the forefront of the market's attention. As long as the Euro stays in this range, I will be more cautious going long as it tests resistance and will be more bullish as it holds support.

Euro intra day:

Euro since April:

The one mistake I made today was not trading energy aggressively enough. I saw the initial breakout in the Euro and noticed commodities were not reacting accordingly. I equated this to weakness whereas I should have loaded up in anticipation of a "catch up" rally. Oil and gold, for instance, rallied 3% and 1% respectively.

A week ago when it felt like everything was going to zero, the market was obviously oversold and I was anticipating an oversold bounce. During the past three trading days, we have experienced that bounce and now SPX is testing some serious resistance levels to the upside (1215 is the next one). This week it will be important to differentiate an oversold bounce with a sustainable rally. I think the Euro/USD will be an important indicator - if it can break the range its been stuck in since hitting yearly highs in May, I expect to see further dollar weakness and a serious rally in commodities. Until then I remain cautious. Tomorrow may be the pivot point.

Market remains range bound, but I now think there is short term risk to the downside because of recent Euro strength, which I'm expecting to reverse tomorrow. Euro hit my target of 1.4550 and has been stuck there pretty much all day. I'm expecting Euro weakness tomorrow on the Sarkozy/Merkel meeting, and Euro debt issues will return to the forefront of the market's attention. As long as the Euro stays in this range, I will be more cautious going long as it tests resistance and will be more bullish as it holds support.

Euro intra day:

Euro since April:

The one mistake I made today was not trading energy aggressively enough. I saw the initial breakout in the Euro and noticed commodities were not reacting accordingly. I equated this to weakness whereas I should have loaded up in anticipation of a "catch up" rally. Oil and gold, for instance, rallied 3% and 1% respectively.

A week ago when it felt like everything was going to zero, the market was obviously oversold and I was anticipating an oversold bounce. During the past three trading days, we have experienced that bounce and now SPX is testing some serious resistance levels to the upside (1215 is the next one). This week it will be important to differentiate an oversold bounce with a sustainable rally. I think the Euro/USD will be an important indicator - if it can break the range its been stuck in since hitting yearly highs in May, I expect to see further dollar weakness and a serious rally in commodities. Until then I remain cautious. Tomorrow may be the pivot point.

Revisiting the Euro

Thursday last week I pointed out the Euro was bouncing off a key support level. This morning I'm seeing the Euro gain a lot of ground vs. USD and is now approaching resistance, a surprising move because Germany opposing Eurobonds today should weaken the Euro. This spike could be partly the result of weak Empire State data out at 8:30 as well as a run up ahead of the Sarkozy/Merkel meeting tomorrow. In terms of the latter, I expect a Euro sell off tomorrow because I think if anything substantial comes out of the meeting, it will be a dovish ECB mandate (ECB has been notoriously too tight in the past). Interesting to note oil and copper are not bouncing on this move - both are relatively flat this morning. Ags are up nicely, though - corn, wheat, sugar, OJ, and rice all up >1%. I will be cautious in the commodity space as I expect Euro resistance around 1.44-1.4450, but looking to trade MOS today on ag strength. If the Euro does break the range and move higher, I will be more bullish on commodities.

Monday morning

+ Japan GDP contracted less than expected, boosting Asia markets. Shanghai up >1%, HK up 3%

+ Swiss National Bank supposedly in talks to curb CHF gains. The central bank is meeting Wed. CHF down this morning which is a risk on indicator

+ Google buying Motorola's mobile phone unit for 12.5 bn or 40/share in cash (65% premium)

+ Euro strengthening vs. USD this morning, could boost risk assets

- Germany opposes Eurobonds. Eyes on Sarkozy and Merkel meeting tomorrow

- Empire State Man. at 8:30 missed big: -7.72 vs. 0.0 expected.

I think we remain range bound today with an upside bias. I am still looking to trade the commodity space which I think got unfairly beaten down in the past couple weeks on forced liquidations. Holding off on financials for now although I think they are cheap.

SPX levels: 1172 support, 1190 resistance. If we break 1172, will look to build longs @ 1150-1152. Next level of resistance above 1190 is 1200.

Friday, August 12, 2011

Update

Stopped out at <1% loss. Really don't like this price action - reminds me of the last hour of Wednesday - a failed break out higher followed by aggressive selling and taking out lows. FCX was underpreforming the market as it crept higher and would get whacked on any down tick. Also it broke the trend line I mentioned before so I stayed disciplined and sold it.

SPX chart:

FCX chart:

Notice the relative underperformance. As the market crept higher, FCX continued to make new lows. Market remains range bound - no longer foresee break out. This weakness towards the end of the day is most likely traders reducing exposure ahead of the weekend and locking in any gains they've seen in the past couple days.

One may ask why I play FCX if my idea is based on the underlying market. A legitimate question because I would have made money on the run up from 1-2 pm, whereas my long FCX position was relatively flat in the same period. First, for the time being my boss has restricted me from trading levered ETFs, so I can no longer make basic market calls. Second, FCX is probably my favorite stock to play because its high beta (1.5), its exposure to Chinese copper demand, and its gold component. Recently gold has had a negative correlation to the market, making it a great hedge. Today however, gold was weak (retracing its parabolic move to record highs) as the level of general uncertainty has diminished, which may have caused weakness in FCX.

SPX chart:

FCX chart:

Notice the relative underperformance. As the market crept higher, FCX continued to make new lows. Market remains range bound - no longer foresee break out. This weakness towards the end of the day is most likely traders reducing exposure ahead of the weekend and locking in any gains they've seen in the past couple days.

One may ask why I play FCX if my idea is based on the underlying market. A legitimate question because I would have made money on the run up from 1-2 pm, whereas my long FCX position was relatively flat in the same period. First, for the time being my boss has restricted me from trading levered ETFs, so I can no longer make basic market calls. Second, FCX is probably my favorite stock to play because its high beta (1.5), its exposure to Chinese copper demand, and its gold component. Recently gold has had a negative correlation to the market, making it a great hedge. Today however, gold was weak (retracing its parabolic move to record highs) as the level of general uncertainty has diminished, which may have caused weakness in FCX.

Update

We tested 1188 but failed to break. Ended up rolling over, gave up a quick 1% gain in FCX and now back to flat.

In terms of damage control, this is what I'm looking at:

I stop myself out if it breaks this line.

To sustain momentum in SPX, we need to hold the original trend line:

In terms of damage control, this is what I'm looking at:

I stop myself out if it breaks this line.

To sustain momentum in SPX, we need to hold the original trend line:

Update

1188 high today right after the open. Hit lows of 1171 after a very weak consumer sentiment number (not unexpected). Anyways, my levels from this morning held pretty well, and it would have been prudent to sell 1188 and cover at 1171. Instead, I took a step back and noticed a wedge forming, which we broke to the upside. I bought a small position in FCX on the break out and I expect to test the 1188 highs. Also interesting to see the breakout coincide with the European close, which this past week has equated to rallying.

Morning update

Some quick levels I'm looking at:

SPX: 1189-1190, 1205, and 1211 as resistance. 1172 and 1150 as support.

Looking for any weakness in Europe to lead a sell off. Will buy dips, half at 1172 and next half 1150.

SPX: 1189-1190, 1205, and 1211 as resistance. 1172 and 1150 as support.

Looking for any weakness in Europe to lead a sell off. Will buy dips, half at 1172 and next half 1150.

Thursday, August 11, 2011

Afternoon update

Looks like risk sentiment has shifted - out of treasuries and gold and into equities:

TLT down 4%

GLD down 3%

SPX up 3.8%

TLT down 4%

GLD down 3%

SPX up 3.8%

Thursday morning

After the Fed statement, I noticed the euro was trying to break out to the upside. Not surprising initial move because according to interest rate parity, exceptionally low rates until 2013 is not good for the dollar. Anyways, looks like the Euro failed to break higher (investors rushed into USD as equities got slammed yesterday) and now is actually trying to break lower this morning on elevated stress in France and Italy. I look at FXE, the Euro ETF, which is hovering around the 141 level this morning. Funny thing is, as I write this SPX futures just bounced 20 and FXE bounced 60 cents or so to 141.10.

Short term chart:

1 yr chart:

Notice the key 141 level. If we hold this, I expect the Euro to move higher back to 144 which will provide support for equities and commodities as USD moves lower.

SPX futures are fluctuating wildly this morning. Up 20 to down 20 (testing 1100 key support) to up 10. Europe is considering banning short selling. Initial jobless claims a little better than expected by 5k. Gold down 1% as CME hikes margin requirements. Treasuries also down. Another interesting thing to note is the Swiss franc, down huge this morning - Swiss National Bank said yesterday it would significantly increase the supply of liquidity to banks and the money market because it believes its currency is massively overvalued. This move lower in FXF is another sign of "risk on" behavior, even if the catalyst is central bank intervention. Seems like everyday we see more policies as a desperate attempt to stem a global crisis: gold margin hikes, ridiculously low US rates, Yen intervention, CHF intervention, possible short selling ban in Europe - all designed to incetivize riskier behavior. The question that remains is whether investors will react accordingly.

Short term chart:

1 yr chart:

Notice the key 141 level. If we hold this, I expect the Euro to move higher back to 144 which will provide support for equities and commodities as USD moves lower.

SPX futures are fluctuating wildly this morning. Up 20 to down 20 (testing 1100 key support) to up 10. Europe is considering banning short selling. Initial jobless claims a little better than expected by 5k. Gold down 1% as CME hikes margin requirements. Treasuries also down. Another interesting thing to note is the Swiss franc, down huge this morning - Swiss National Bank said yesterday it would significantly increase the supply of liquidity to banks and the money market because it believes its currency is massively overvalued. This move lower in FXF is another sign of "risk on" behavior, even if the catalyst is central bank intervention. Seems like everyday we see more policies as a desperate attempt to stem a global crisis: gold margin hikes, ridiculously low US rates, Yen intervention, CHF intervention, possible short selling ban in Europe - all designed to incetivize riskier behavior. The question that remains is whether investors will react accordingly.

Wednesday, August 10, 2011

The close

Last hour was not so nice. Obviously would have been prudent to sell into the afternoon rally, but I had conviction the "rip your face off" rally was just around the corner so I let my long ride. Gave up a 3.5% gain and ended up selling on the close at a 50 bps loss.

The inverted H/S worked and we broke 1150 to the upside hitting a high of 1159. We bounced off 1150 a few times then broke to the downside. In retrospect this is the point I should have sold some. Instead I watched the market sell aggressively all the way down to 1129, which we sliced through with 10 min left in trading, and closed at the lows -- 1120.

Despite turning a nice gain into a small loss, I'm not too disappointed because I learned a couple things:

1. I need to be comfortable letting longs ride when the market actually turns because the upside returns are potentially enormous.

2. Tomorrow we will test the lows on Tuesday (1100). If we break, look out below -- we could easily see 1060.

The inverted H/S worked and we broke 1150 to the upside hitting a high of 1159. We bounced off 1150 a few times then broke to the downside. In retrospect this is the point I should have sold some. Instead I watched the market sell aggressively all the way down to 1129, which we sliced through with 10 min left in trading, and closed at the lows -- 1120.

Despite turning a nice gain into a small loss, I'm not too disappointed because I learned a couple things:

1. I need to be comfortable letting longs ride when the market actually turns because the upside returns are potentially enormous.

2. Tomorrow we will test the lows on Tuesday (1100). If we break, look out below -- we could easily see 1060.

Afternoon update

We broke the descending wedge to the upside, but after a couple spurts higher, fizzled out well below the 1150 level. What I'm looking now is a possible inverted head and shoulders formation (not a perfect one though) and a new trend line to the upside. If we can rally back to 114.60 and break higher, this could give the market some momentum.

What I'm looking at this morning

Some simple techinicals on SPX I'm eying:

3. 10:31 am

This turned out to be a preemptive call. Failed break out of the first descending trend line so I added the second (higher) trend line which is creating the descending wedge.

4. 10:57 am

It's 11:43 am and we still haven't broken either way.

Pre mkt, SPX was well above 1150, which led me to believe we would stick in a range between 1150 and 1190. However, futures sliced through technical support as Euro banks starting getting crushed, some down 10%. The DAX rolled over from positive to down 3%. So when the US market opened, we were back to the 1129-1150 range, which I've been watching for days.

There's a possible descending wedge forming right now. Because we continue to hold 1129 area, I believe we break to the upside and test 1150, so I'm currently holding my only position FCX, which I picked up at 43.79 this morning. It's holding nicely as gold continues to outperform.

Here are my real time tweets which correspond to the chart above (click to see details):

1. 9:51 am

2. 10:19 am

3. 10:31 am

This turned out to be a preemptive call. Failed break out of the first descending trend line so I added the second (higher) trend line which is creating the descending wedge.

4. 10:57 am

It's 11:43 am and we still haven't broken either way.

Tuesday review

What we learned from the Fed statement: USD is more screwed than anyone imagined. Now that the Bernank has given us a time frame for further dollar destruction (funds rate exceptionally low through mid 2013), I can safely say this is a pretty good entry point for commodities. I especially like oil and copper, both of which have been absolutely crushed these past couple weeks. The main driver of gold is no longer a safe haven from uncertainty but an alternative currency to those being debased.

Break out du jour post Fed:

Looks like USD is no longer gaining ground on the Euro, breaking the down trend line. I expect it to test the short term highs of 144.75 sooner rather than later, driving commodities higher. Not surprisingly we see oil 4% higher this morning -- still a great entry point in my opinion. I am still cautiously bullish -- obviously more bullish than two weeks ago because I believe some great companies are now on sale due to forced liquidations by institutional investors and retail panic selling -- but cautious because the Fed was much more dovish on economic fundamentals than I expected. Goldman sees a 1/3 chance of another recession, in which case they say "QE3 is their base case" scenario, which is negative for USD. So we have two forces at play which could potentially neutralize commodities: a weakening dollar coupled with a weakening economy. However, I still think there is upside pressure to commodities because economic expectations have been downgraded to such an extent positive surprises are likely. Also, demand from emerging markets will ultimately drive commodities higher, until of course we see a hard landing in China (possible real estate bubble).

I like FCX on a reversal to the upside. Looking at a 44.30 entry this morning, with a 47 target and 43 stop.

I will be continuing to watch SPX: 1170 resistance and 1150 support. If we break 1170, looking to test 1190 and then 1202. In Europe we are seeing a shift of risk from the periphery to core countries, with Greece and Ireland CDS coming in (Italy still at elevated levels) while Germany and France CDS trending higher.

Break out du jour post Fed:

Looks like USD is no longer gaining ground on the Euro, breaking the down trend line. I expect it to test the short term highs of 144.75 sooner rather than later, driving commodities higher. Not surprisingly we see oil 4% higher this morning -- still a great entry point in my opinion. I am still cautiously bullish -- obviously more bullish than two weeks ago because I believe some great companies are now on sale due to forced liquidations by institutional investors and retail panic selling -- but cautious because the Fed was much more dovish on economic fundamentals than I expected. Goldman sees a 1/3 chance of another recession, in which case they say "QE3 is their base case" scenario, which is negative for USD. So we have two forces at play which could potentially neutralize commodities: a weakening dollar coupled with a weakening economy. However, I still think there is upside pressure to commodities because economic expectations have been downgraded to such an extent positive surprises are likely. Also, demand from emerging markets will ultimately drive commodities higher, until of course we see a hard landing in China (possible real estate bubble).

I like FCX on a reversal to the upside. Looking at a 44.30 entry this morning, with a 47 target and 43 stop.

I will be continuing to watch SPX: 1170 resistance and 1150 support. If we break 1170, looking to test 1190 and then 1202. In Europe we are seeing a shift of risk from the periphery to core countries, with Greece and Ireland CDS coming in (Italy still at elevated levels) while Germany and France CDS trending higher.

Tuesday, August 9, 2011

Update

Good rally off the lows with financials leading up 4%,. Nice bounce in C. I guess screaming over and over "why is C down 20%!" yesterday was not unfounded.

1150 is proving tough to break, even with gold coming off its highs and treasuries lower on the day. If we do break 1150, I'm looking at 1170 as another level of resistance. (I kept my levels from yesterday in there)

Sitting on my hands for now, even though I'm kicking myself for not buying C. There will be many opportunities like this and I keep reminding myself we'll most likely see lower levels.

1150 is proving tough to break, even with gold coming off its highs and treasuries lower on the day. If we do break 1150, I'm looking at 1170 as another level of resistance. (I kept my levels from yesterday in there)

Sitting on my hands for now, even though I'm kicking myself for not buying C. There will be many opportunities like this and I keep reminding myself we'll most likely see lower levels.

Tuesday morning

There is a fine line separating savvy contrary thought and a reckless fight with markets. Remember, the crowd is what drives the price action, and you want to ride them until they turn into an unthinking mob. - Barry Ritholtz

A simple portfolio rebalancing - Felix Salmon

Watch gold and watch treasury yields - Upside Trader

We survived the night. Futures are indicated higher this morning, despite being down about 2% a few hours ago. Treasuries are down which is a good sign, but gold is up about 2%. Before I try to catch falling knives I want to see gold reverse lower.

A simple portfolio rebalancing - Felix Salmon

Watch gold and watch treasury yields - Upside Trader

We survived the night. Futures are indicated higher this morning, despite being down about 2% a few hours ago. Treasuries are down which is a good sign, but gold is up about 2%. Before I try to catch falling knives I want to see gold reverse lower.

Monday, August 8, 2011

Overnight

Global markets in free fall with SPX down almost 3%, Hong Kong off 7.5% and Korea down 10%. Gold is continuing its parabolic rise testing 1750 and oil is down another 5% to 78.

I'm expecting the Bernank to suggest additional easing tomorrow, maybe even a statement pre mkt, hours before the official Fed release, if the futures do not bounce. Any QE3 talk and I'm loading into TBT - many expect the next round of bond purchasing to target the long end of the yield curve. Why short long dated treasuries on news of quantitative easing? Because QE is essentially the monetization of US debt, and printing money increases inflationary pressures which will ultimately steepen the yield curve. It is counter intuitive but worked beautifully after QE2 - investors were basically forced out of risk free treasuries and into riskier assets such as equities and commodities.

Sitting on the sidelines for now until I see a substantial move to the upside accompanied by high volume and momentum. Expecting financials to get hit again tomorrow - should be interesting to see where BAC and C find their next support. Also going to take a look at the beaten down energy sector for possible value plays.

I'm expecting the Bernank to suggest additional easing tomorrow, maybe even a statement pre mkt, hours before the official Fed release, if the futures do not bounce. Any QE3 talk and I'm loading into TBT - many expect the next round of bond purchasing to target the long end of the yield curve. Why short long dated treasuries on news of quantitative easing? Because QE is essentially the monetization of US debt, and printing money increases inflationary pressures which will ultimately steepen the yield curve. It is counter intuitive but worked beautifully after QE2 - investors were basically forced out of risk free treasuries and into riskier assets such as equities and commodities.

Sitting on the sidelines for now until I see a substantial move to the upside accompanied by high volume and momentum. Expecting financials to get hit again tomorrow - should be interesting to see where BAC and C find their next support. Also going to take a look at the beaten down energy sector for possible value plays.

Monday review

Total bloodbath. SPX down 6.5%

Glad I stayed out of the market. Gold and treasuries basically the only two things up. Financials got smoked with BAC and C down 20%. XLF down 9.5%.

The levels I was looking at this morning: 1168, 1150, and 1129. Once we broke 1150 I tweeted about the lack of support below and half joked we would test 1129. We not only tested it, we semi crashed through it, hitting a 1119 low. This move felt like the capitulation everyone was waiting for so I expected the start of a relief rally. We bounced hard only to be met by more very aggressive selling, closing at the low of the day.

Morning update

Despite closing relatively flat on the day, Friday was ugly. Not even a better than expected jobs report could support this market. We broke the 1178 support in SPX and it felt like Flash Crash 2.0 was just around the corner when ECB announced a bond purchase program. Market rallied hard on this news - about 40 pts.

Couple take aways:

1. Gold did not sell off as the market ripped higher. My thesis is gold is the ultimate source of funds, and as equities rally, gold investors will sell their winning positions to raise cash to build positions in beaten down stocks. Also, I think uncertainty is a big catalyst for gold's parabolic move higher, so any news that reduces uncertainty should lessen the demand for gold. However, ECB's commitment to quantitative easing is positive for metals.

2. Financials continued to lag - C and BAC both down around 8%. Seems like short sellers are leaning hard, trying to break HF titans who have massive positions in these banks (Paulson). Meanwhile sell side institutions like Wachovia and S&P rushed to downgrade and cut price forecasts. BAC also announced claims from Fannie Mae and Freddie Mac will cost more than previously forecasted.

Friday after the close, S&P goes for the jugular and downgrades US debt to AA+. Not exactly unexpected news but a brutal blow to confidence.

Monday morning is a bloodbath across the board with futures ranging from -2 to -3%. Treasuries are slightly higher, a counter intuitive safe-haven play that will soon reverse (I'm looking for a bounce in TBT). Gold, the ultimate safe haven currency, is up 2.5% breaking 1700. BAC down another 8% pre mkt on news AIG is suing them for 10 bn.

Interesting to note that while the futures are down big, we are sitting just above the lows on Friday, leading me to believe that a lot of this is already baked in. Attention is on Europe, and at least for now the bond purchase program is having a positive affect - Spain and Italy bonds are ripping, lowering their 10 yr borrowing costs by about 80 bps.

I'm stepping back for now - looking to short treasuries once they settle down and possibly the financials on any QE3 announcements. My gold short idea looks like its officially broken - ECB QE and US debt downgrade are both very positive catalysts.

Levels: looking at Friday's low of 1168. Below that, 1150.

Couple take aways:

1. Gold did not sell off as the market ripped higher. My thesis is gold is the ultimate source of funds, and as equities rally, gold investors will sell their winning positions to raise cash to build positions in beaten down stocks. Also, I think uncertainty is a big catalyst for gold's parabolic move higher, so any news that reduces uncertainty should lessen the demand for gold. However, ECB's commitment to quantitative easing is positive for metals.

2. Financials continued to lag - C and BAC both down around 8%. Seems like short sellers are leaning hard, trying to break HF titans who have massive positions in these banks (Paulson). Meanwhile sell side institutions like Wachovia and S&P rushed to downgrade and cut price forecasts. BAC also announced claims from Fannie Mae and Freddie Mac will cost more than previously forecasted.

Friday after the close, S&P goes for the jugular and downgrades US debt to AA+. Not exactly unexpected news but a brutal blow to confidence.

Monday morning is a bloodbath across the board with futures ranging from -2 to -3%. Treasuries are slightly higher, a counter intuitive safe-haven play that will soon reverse (I'm looking for a bounce in TBT). Gold, the ultimate safe haven currency, is up 2.5% breaking 1700. BAC down another 8% pre mkt on news AIG is suing them for 10 bn.

Interesting to note that while the futures are down big, we are sitting just above the lows on Friday, leading me to believe that a lot of this is already baked in. Attention is on Europe, and at least for now the bond purchase program is having a positive affect - Spain and Italy bonds are ripping, lowering their 10 yr borrowing costs by about 80 bps.

I'm stepping back for now - looking to short treasuries once they settle down and possibly the financials on any QE3 announcements. My gold short idea looks like its officially broken - ECB QE and US debt downgrade are both very positive catalysts.

Levels: looking at Friday's low of 1168. Below that, 1150.

Thursday, August 4, 2011

Morning update

Surprise surprise, futures down big. Gold and treasuries up. Euro getting hit -- ECB left interest rates unchanged and traders buying USD as safe haven. Obviously should have bought some EUO ahead of ECB, still looking nice, will build a position today.

Unemployment claims out at 8:30 -- expecting 403k.

---------

Update: Claims not that bad at 400k. Market doesnt care, still down big. Euro getting whacked. Gold going parabolic. Bought EUO pre mkt -- ECB buying Italy bonds, basically ramping up their QE initiative.

Unemployment claims out at 8:30 -- expecting 403k.

---------

Update: Claims not that bad at 400k. Market doesnt care, still down big. Euro getting whacked. Gold going parabolic. Bought EUO pre mkt -- ECB buying Italy bonds, basically ramping up their QE initiative.

Wednesday, August 3, 2011

Wednesday review

ADP was slightly better and non-manufacturing ISM was a miss, but probably not as bad as everyone was expecting after such terrible ISM last week. Although these numbers led the market lower in the morning, sentiment took control in the afternoon. The market was insanely oversold - the DOW had been down for 8 days straight. To put this streak in perspective, the last time it was down for 9 straight was 1978. An oversold market bounce was widely anticipated, and even the guys on the floor were forecasting a snap back rally, one reason why I was a bit skeptical. Raising cash yesterday, although painful, ended up being the right move because I patiently watched a panic stricken market plunge to 123 in SPY, one possible level of support I had been eying pre mkt and one which I did not think we would reach. I was lucky enough to be flush with cash at this point and picked the bottom nicely.

In my morning update, I mentioned the importance of differentiating an oversold bounce with a sustained upward trend. What we saw today was simply an oversold bounce so I will be very cautious to buy this market in the short term. Looking to buy only on dips at levels of possible SPX support.

Two observations from today:

1. Euro strength despite a worsening credit outlook. Now that the debt ceiling issue is behind us (for now), I anticipate market attention to return to Europe. Looking to build an EUO position on deteriorating conditions. Also I like EUO has a general hedge because traders tend to buy USD as a safe haven during times of uncertainty.

2. Gold and treasury weakness as equities staged a relief rally. Looking to short both after any extreme sell offs and subsequent bounces off support.

In my morning update, I mentioned the importance of differentiating an oversold bounce with a sustained upward trend. What we saw today was simply an oversold bounce so I will be very cautious to buy this market in the short term. Looking to buy only on dips at levels of possible SPX support.

Two observations from today:

1. Euro strength despite a worsening credit outlook. Now that the debt ceiling issue is behind us (for now), I anticipate market attention to return to Europe. Looking to build an EUO position on deteriorating conditions. Also I like EUO has a general hedge because traders tend to buy USD as a safe haven during times of uncertainty.

2. Gold and treasury weakness as equities staged a relief rally. Looking to short both after any extreme sell offs and subsequent bounces off support.

Mid day update

Starting fresh was prudent. I was able to buy the extreme dip this morning. SPY low was 123.53 -- I was a buyer at 123 (see previous post). I let treasuries and gold run even farther, then built shorts in both and a small long position in oversold banks. Then SPY formed a wedge formation, called the breakout correctly, and let my positions run. Sold a third into the initial rally.

Morning update

In times of uncertainty, I always think it's prudent to step back, take a breather, raise some cash, and start fresh. I am currently out of all positions. On my watch list:

1. Gold - seems to be starting its parabolic move, which signals the beginning of the end. I am watching carefully and will look to short if it turns.

2. Treasuries - This risk free market seems to be trending nicely with gold, making a parabolic move higher. I'm going to let it go for now, and look to short via TBT on positive economic news or a sustained bounce in equities.

3. Financials - yet to find a bottom. I am cautiously building longs - need to be careful to differentiate an oversold bounce with a sustained bottoming pattern and reversal of risk sentiment.

What worries me most (click for detail):

Very little technical support below these levels, and although the market feels oversold, we're flat YTD. I'm looking at 123 as possible support, and below that, possibly 119. Sometimes it's mentally exhausting to be a contrarian, but as I always say: "take care of the downside, and the upside will take care of itself." ADP just came out, beating expectations by 4k. Slightly less pessimism pre mkt. Short term oversold bounce is very possible, but I think 130 is going to be tough to break.

1. Gold - seems to be starting its parabolic move, which signals the beginning of the end. I am watching carefully and will look to short if it turns.

2. Treasuries - This risk free market seems to be trending nicely with gold, making a parabolic move higher. I'm going to let it go for now, and look to short via TBT on positive economic news or a sustained bounce in equities.

3. Financials - yet to find a bottom. I am cautiously building longs - need to be careful to differentiate an oversold bounce with a sustained bottoming pattern and reversal of risk sentiment.

What worries me most (click for detail):

Very little technical support below these levels, and although the market feels oversold, we're flat YTD. I'm looking at 123 as possible support, and below that, possibly 119. Sometimes it's mentally exhausting to be a contrarian, but as I always say: "take care of the downside, and the upside will take care of itself." ADP just came out, beating expectations by 4k. Slightly less pessimism pre mkt. Short term oversold bounce is very possible, but I think 130 is going to be tough to break.

Tuesday, August 2, 2011

Tuesday review

Lot of take aways from today. The Senate voted on the debt deal and it passed. SPX fell 2.6% and is now down on the year.

4/5 of my positions were poised for a rally on the deal. I thought we were oversold and expected a relief rally which never came. As I pointed out this morning the biggest move today was rates - 10 yr hit fresh yr lows of 2.6% and the 30 yr broke 4% and closed at 3.93. An insatiable appetite for risk free assets and lower global growth targets sent TLT up 3% and is now touching the down trendline I posted this morning. I attempted to buy TBT on an oversold bounce and got wiped out. I also got stopped out of my core FAS position as XLF broke 14.50. It closed down 2.7% at 14.35. I also shorted gold on the resolution of the debt issue -- less uncertainty -- which has been the main catalyst for gold recently. Risk aversion trumped this thesis and sent gold to record nominal highs, up 38 to 1659. My only winner on the day was EUO, which I sold for a marginal profit. Overall a very painful day, took my losses, which ended up erasing all of July's gains. Need to learn to keep tighter stops.

One technical I got right this morning is SPY breaking yesterday's lows and testing 126. This is our third test of 1250s in SPX and there is very little support below here, possible 1220. Another interesting technical is SPX falling below the 200 mda and breaking the uptrend line which was put in place since the lows in 2009.

4/5 of my positions were poised for a rally on the deal. I thought we were oversold and expected a relief rally which never came. As I pointed out this morning the biggest move today was rates - 10 yr hit fresh yr lows of 2.6% and the 30 yr broke 4% and closed at 3.93. An insatiable appetite for risk free assets and lower global growth targets sent TLT up 3% and is now touching the down trendline I posted this morning. I attempted to buy TBT on an oversold bounce and got wiped out. I also got stopped out of my core FAS position as XLF broke 14.50. It closed down 2.7% at 14.35. I also shorted gold on the resolution of the debt issue -- less uncertainty -- which has been the main catalyst for gold recently. Risk aversion trumped this thesis and sent gold to record nominal highs, up 38 to 1659. My only winner on the day was EUO, which I sold for a marginal profit. Overall a very painful day, took my losses, which ended up erasing all of July's gains. Need to learn to keep tighter stops.

One technical I got right this morning is SPY breaking yesterday's lows and testing 126. This is our third test of 1250s in SPX and there is very little support below here, possible 1220. Another interesting technical is SPX falling below the 200 mda and breaking the uptrend line which was put in place since the lows in 2009.

Levels

SPY -- sitting at yesterday's lows. If we break, we can easily test 126. I'm looking for a risk reversal today, especially after the Senate votes and passes the debt deal. 129 and 130.50 targets on the upside.

XLF -- 14.50 support. 15.08 target to sell half longs, then 15.25

FXE -- breaking yesterday's lows of 141.30 pre mkt. First stop, 140.50. Looking to sell half EUO at 140 and then rest at 139.50

FXY -- if breaks 127.50, gaps down to 126.85. Looking to play YCS on intervention.

Two technical reasons I like TBT here:

XLF -- 14.50 support. 15.08 target to sell half longs, then 15.25

FXE -- breaking yesterday's lows of 141.30 pre mkt. First stop, 140.50. Looking to sell half EUO at 140 and then rest at 139.50

FXY -- if breaks 127.50, gaps down to 126.85. Looking to play YCS on intervention.

Two technical reasons I like TBT here:

Subscribe to:

Comments (Atom)